How to ensure compliance in the workplace

In this article, we discuss how to ensure workplace compliance through understanding regulations, creating policies, training employees, and updating procedures regularly.

What are regulatory compliance requirements? Laws and regulations relating to business are intended to ensure that companies are operating in a manner that is safe for both employees and the public. These requirements can be defined as an adherence to all applicable laws and regulations in the country or countries in which a company is operating. Having laws and regulations that all businesses follow helps level the playing field between companies and raises standards for citizens. Businesses that do not follow these laws and regulations can be subject to heavy fines or even closure. In short, regulatory compliance helps protect both businesses and consumers.

How to ensure compliance with regulatory requirementsCopied

By taking proactive steps to ensure regulatory compliance, businesses can improve their operations, protect their employees and customers, and reduce the risk of fines or penalties.

The following steps outline how a business can create a workplace culture of regulatory compliance that will help the company meet its legal obligations and ensure that it can effectively compete in today’s marketplace.

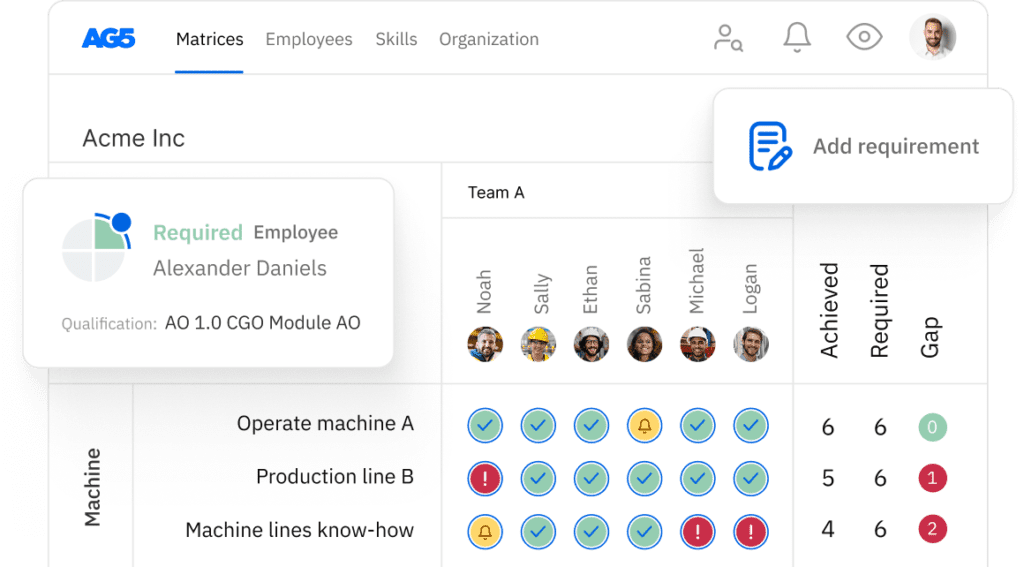

- First, laws and industry regulations will need to be reviewed to determine which ones apply. This might sound like a daunting task, but there are many resources available that can help streamline this process.

- Once the applicable laws and regulations have been identified, company policies and procedures will need to be created or updated to ensure compliance. An effective monitoring and auditing system will also need to be set up so that any areas of non-compliance can be quickly identified and corrected.

- With compliance and monitoring policies and procedures in place, employees and new hires will need to be trained on the importance of compliance – and how to comply with company procedures.To make this process run smoothly,, existing and new employees can be invited to compliance interviews. A compliance interview is a meeting between a company representative and a current or prospective employee. The purpose of the meeting is to ensure that the employee understands and is willing to comply with the company’s policies and procedures.

- Finally, the compliance program will need to be monitored on a regular basis to ensure that it is up to date with new laws or regulations that relate to the business and industry. By regularly reviewing its compliance policies, a business will be able to keep up with changing regulations, update employees on new business procedures, and ensure that its processes remain compliant with regulations.

Why is regulatory compliance important?Copied

Business owners and managers are always looking for ways to increase profitability. One way to do so is by ensuring that the company is compliant with all applicable laws and regulations, as one benefit of regulatory compliance is the avoidance of potentially costly penalties or fines.

Regulatory compliance also gives businesses the ability to operate with a high degree of certainty and confidence, as they know they are not at risk of being shut down by government regulators.

Finally, compliant businesses often enjoy a competitive advantage over those that flout the law. This is because customers and investors are increasingly interested in doing business with companies that adhere to high standards of ethical conduct. For these reasons, compliance should be seen as an opportunity to further improve the profitability of any business, regardless of industry.

Regulatory compliance costsCopied

Regulatory compliance costs fall into two main categories: direct and indirect.

Direct costs are those incurred in the process of complying with regulations, such as the cost of an in-house compliance officer or new compliance-tracking software. Indirect costs are those that are not directly related to compliance, such as the opportunity cost of investing time and resources in regulatory compliance.

While the financial impact of compliance can be substantial, it is essential to remember that the cost of non-compliance will be even higher. Businesses that fail to comply with regulations will face heavy fines, reputational damage, and lost customers. In extreme cases, companies may even be forced to shut down entirely.

How to maintain compliance with regulatory requirementsCopied

Any business, no matter its size, industry, or location, faces various risks when it comes to maintaining regulatory compliance. Therefore, businesses should take several steps to do so.

First, they should keep up to date with all the relevant laws and regulations. Second, they should develop a comprehensive compliance plan that outlines how they will comply with all applicable laws. Businesses should also implement systems and procedures to ensure that all employees fully understand and follow compliance plans.

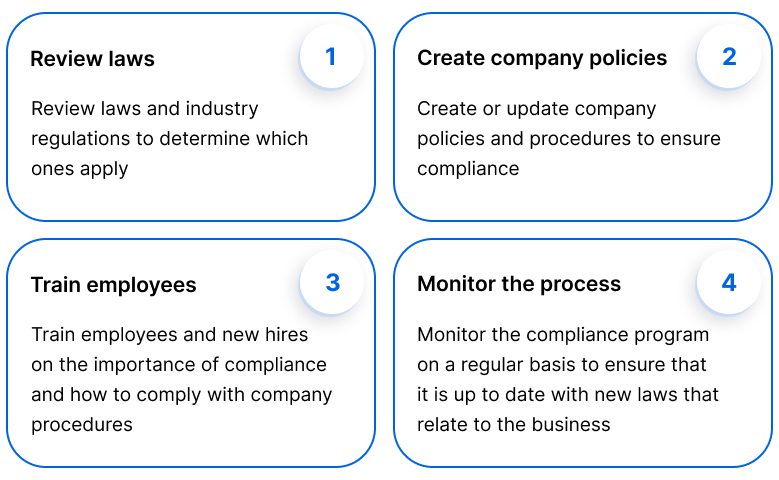

Below are some of the most common compliance risks faced by businesses:

- Changing laws and regulations. Governments routinely pass new laws and regulations that can affect businesses. For example, a change in environmental regulations could require businesses to implement costly upgrades to their facilities. A new law prohibiting discrimination could require businesses to amend hiring practices or layouts of office buildings. Failure to comply with these changes could result in significant penalties.

- New technologies. The ever-changing technology landscape continually creates new compliance risks for businesses. For example, moving onto cloud-based services may subject a company to additional data privacy laws. Or the use of autonomous vehicles as company cars could lead to having new safety regulations to take into account. Businesses should be aware of any new laws and regulations relating to new technologies and strive to stay ahead of the curve by acting quickly to comply with all relevant laws and regulations.

- Increased scrutiny from regulators. Regulators are under constant pressure to crack down on non-compliant businesses. Companies that cannot prove they are complying with all applicable laws and regulations will be subject to costly investigations and could be given hefty fines.

- Globalization. The globalization of business has led to a complex web of laws and regulations. Businesses must now navigate a patchwork of different laws to stay compliant. This can be a daunting task, particularly for small businesses. However, there are resources available that can help businesses stay on top of global industry regulations and standards.

Manufacturing and regulatory complianceCopied

Manufacturers must adhere to many different compliance requirements to ensure their products’ safety and quality. These requirements can vary depending on the product being manufactured, but they typically include material specifications, quality standards, and testing and certification procedures. In addition, manufacturers must comply with regulations regarding product labeling and packaging.. Failure to comply with these requirements can result in substantial fines and penalties. As a result, manufacturers must understand the compliance requirements that apply to their businesses and industries.

What is healthcare regulatory compliance?Copied

In the healthcare industry, regulatory compliance refers to the adherence to guidelines set forth by external agencies, such as government regulatory agencies and insurance companies.

Regulatory compliance is essential in healthcare, as it helps prevent fraud and abuse that endanger patient safety. Non-compliance can lead to costly penalties. An efficient and reliable compliance program includes four key components: policies and procedures, training and education, audits and monitoring, and reporting and communication.

With these components in place, healthcare organizations can ensure that their employees are adhering to the standards set by the relevant regulatory agencies. A robust compliance program also ensures that the healthcare products or services offered are safe – and that patients receive the high-quality care they deserve.

What is PCI compliance in healthcare?Copied

Payment Card Industry (PCI) compliance refers to a set of security standards that must be met by organizations that process, store, or transmit credit card information. The PCI Security Standards Council was formed in 2006 by major credit card brands to help protect cardholders from fraud and data breaches. The council develops and maintains the PCI Data Security Standard (PCI DSS), which outlines 12 requirements for PCI compliance.

The PCI DSS 12 requirements are as follows:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update antivirus software

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need-to-know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security

Healthcare organizations that process, store, or transmit credit card information must meet all 12 requirements to be PCI-compliant. Failure to comply with the PCI DSS can lead to significant fines and penalties, as well as increased risk of data breaches and fraud.

What is SOX compliance?Copied

In the wake of corporate scandals such as Enron and WorldCom, the Sarbanes-Oxley Act of 2002 (SOX) placed new requirements on public companies, including increased disclosure, stronger internal controls, and more independent oversight.

Businesses are SOX-compliant when they ensure that their financial information is accurate and meets all regulatory requirements. While many companies initially found SOX compliance to be a burden, the benefits of improved financial reporting soon became apparent. For investors, SOX compliance provides greater confidence in a company’s financial statements. For employees, it creates a culture of accountability. And for businesses, it improves organizational efficiency and helps avoid costly mistakes.

Ultimately, SOX compliance is about instilling trust in markets and ensuring that companies are run with integrity and transparency.

SOX compliance in healthcareCopied

SOX compliance in healthcare refers to the regulatory requirements set forth by the Sarbanes-Oxley Act of 2002. These requirements are designed to protect investors from fraud and ensure the accuracy of financial statements.

SOX compliance typically applies to hospitals and other patient-care providers in the healthcare industry. While the details of SOX compliance may vary from organization to organization, there are several common elements that require universal compliance.. These include the creation of internal controls, the performance of annual audits, and the implementation of policies and procedures related to financial reporting. By meeting these requirements, healthcare organizations can help ensure their financial statements’ accuracy,and protect themselves from potential liability.

SOX compliance roles and responsibilitiesCopied

A Senior SOX Compliance Analyst is a company’s curator regarding risk safeguarding. . This role is responsible for preparing and carrying out a risk-based audit plan to ensure that key operational and finance activities are current and compliant with governance standards. In other words, a Senior SOX Compliance Analyst keeps an eye on company processes and makes suggestions for improvements to maintain high levels of control, reporting directly to organizational management. This role reports directly to management, So if anyone has their finger on the pulse of what’s going on in compliance, it’s the Senior SOX Compliance Analyst.

What is HIPAA compliance?Copied

Established in 1996, the Health Insurance Portability and Accountability Act (HIPAA) is a set of federal regulations that aims to protect the privacy of patients’ personal health information (PHI).

HIPAA compliance ensures that health plans, healthcare providers, and other organizations that handle PHI adhere to strict data privacy standards. To comply with HIPAA, organizations must take measures to safeguard PHI from unauthorized access, use, or disclosure. This includes developing policies and procedures for handling PHI, providing staff training on HIPAA compliance, and implementing physical, technical, and administrative security controls. Failure to comply with HIPAA can result in hefty fines and other penalties.

What is a key to success for HIPAA compliance?Copied

Implementing regular required training for employees, establishing standard procedures for every situation – and staying up to date with software updates and security systems – is the key to success for HIPAA compliance.

Employees need to understand HIPAA and their roles in complying with it. They also need to know how to report any violations they witness. Procedures must be in place so that when a violation does occur, the appropriate steps are taken quickly to mitigate any damage and prevent further violations. Finally, it’s important to stay current on changes to HIPAA laws and regulations, as well as advances in security technology..

What is ADA compliance?Copied

The Americans with Disabilities Act (ADA) ensures that a physical space is accessible to people with disabilities. These regulations include requirements to provide ramps for wheelchair users, doorways that are wide enough to accommodate wheelchairs, and signs in braille for visually impaired individuals.

ADA compliance is extremely important for ensuring the safety of those with disabilities. It also provides everyone with an equal opportunity to access businesses and government buildings, as well as other public spaces.

Why is ADA compliance important?Copied

ADA compliance is substantial because it ensures everyone has equal access to facilities and services. It also helps to create safe environments for all users. When businesses and organizations comply with the ADA, they are taking active steps in helping to improving the lives of people with disabilities – and making their facilities safer and more accessible to everyone.

A business that does not have an accessible entrance, for example, may exclude potential customers who use wheelchairs. And if a public restroom is not ADA-compliant, individuals with specific disabilities may not be able to use it. . This could cause health problems or even dangerous situations. Additionally, non-ADA-compliant facilities are often cluttered and difficult to navigate, posing potential safety hazards. .

UK & EU

What is GDPR compliance?Copied

The European Union (EU)’s General Data Protection Regulation (GDPR) is a data protection regulation that applies to all EU member states, and to any company that processes the personal data of individuals within the EU, regardless of where it is based.

To comply with GDPR, data controllers must appoint a data protection officer (DPO), implement risk management processes, and establish an incident response plan. Personal data must be processed lawfully, transparently, and for a specified purpose. Data must also be accurate and up to date, and be erased or destroyed when no longer needed. Individuals have the right to access and change their data, as well as restrict or withdraw consent to its processing. The GDPR also requires that companies take steps to protect the personal data they process from unauthorized access, disclosure, or destruction.

Challenges in GDPR complianceCopied

Since coming into effect, the GDPR has posed several challenges to organizations. In particular, there are four key areas where organizations face compliance challenges:

- The GDPR prohibits the transfer of personal data to countries outside the EU unless certain conditions are met. This has proved to be a challenge for many organizations that need to transfer data to conduct international business.

- The GDPR requires organizations to provide detailed information to individuals about how their data will be processed. This can be a challenge, as it requires organizations to fully understand their data processing activities.

- The GDPR gives individuals the right to access their data, or request that it be corrected or deleted. However, verifying the identity of individuals can be challenging, primarily when they are based in different countries.

- Under the GDPR, public bodies are only allowed to share personal data if certain conditions are met. This can be challenging when dealing with large amounts of data and multiple public bodies.

What is a GDPR risk assessment?Copied

A GDPR risk assessment is vital for any company handling the data of EU citizens. By understanding the risks and vulnerabilities, a company can work out ways to protect this data. The process involves identifying, analyzing, and evaluating threats and vulnerabilities. In doing so, a company can develop strategies to prevent or mitigate the impact of these risks. For example, if a risk assessment reveals that employees are the biggest threat to data security, a company might implement training to raise awareness of data protection issues. By taking these steps, a company can help to protect the data of its customers and employees.

Who is responsible for ensuring businesses are GDPR-compliant?Copied

It is the responsibility of companies to ensure that their practices are in line with GDPR requirements. However, there are a number of different ways of ensuring compliance, and there is no one-size-fits-all solution. In many cases, it is necessary to work with a GDPR compliance expert to develop a tailored approach that meets a company’s specific needs.