Financial services skills matrix template

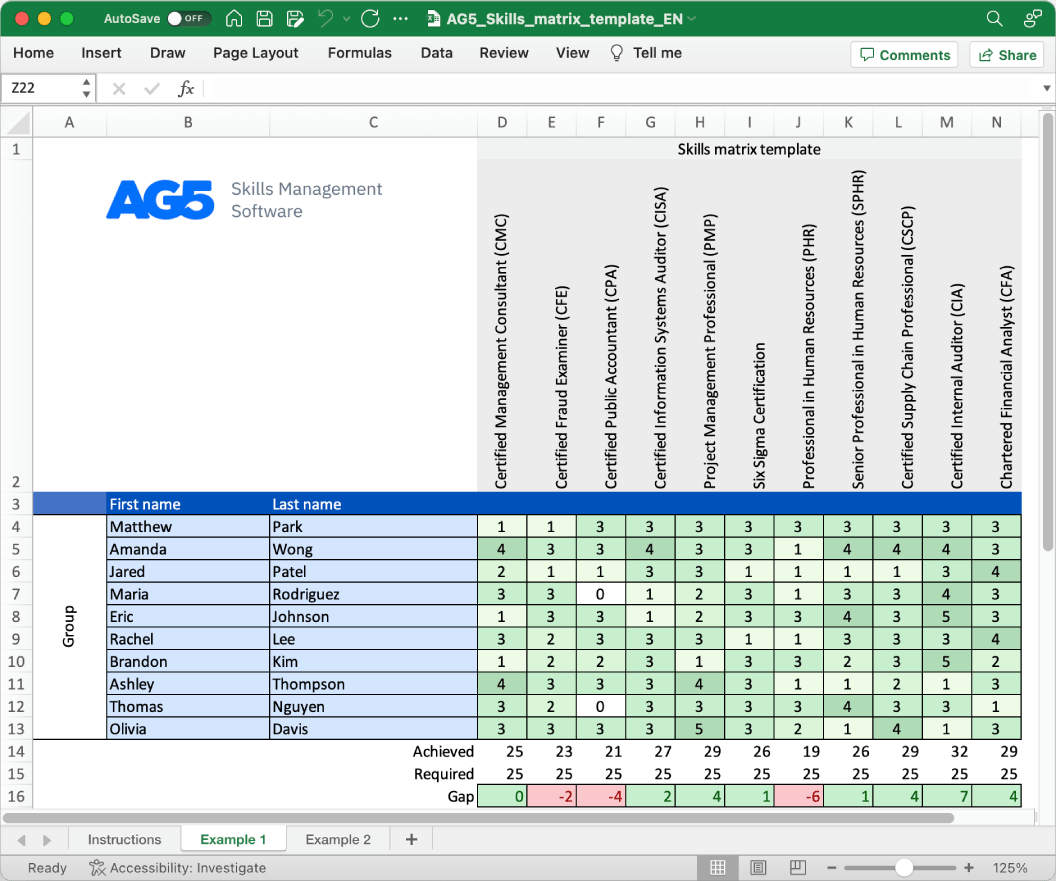

A skills matrix template is a tool that can be used in financial services organizations to effectively manage and assess the skills and knowledge of individual employees or teams.

Download your free template here

Overview Copied

With our free financial services skills matrix template, you will receive a clear overview of the skills that are present in your organization, as well as those that are missing. Using this information, you can develop and implement a plan to ensure that your employees’ skills are up to date, comprehensive, compliant, and ready for the future.

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Investment Management Analyst (CIMA)

- Certified Internal Auditor (CIA)

- Certified Trust and Financial Advisor (CTFA)

- Financial Risk Manager (FRM)

- Personal Financial Specialist (PFS)

- Certified Financial Services Auditor (CFSA)

- Certified Financial Services Security Professional (CFSSP)

- Certified Financial Consultant (CFC)

- Certified Fund Specialist (CFS)

- Certified Investment Banking Associate (CIBA)

- Certified Investment Management Consultant (CIMC)

- Chartered Alternative Investment Analyst (CAIA)

- Certified Government Financial Manager (CGFM)

- Certified Bank Auditor (CBA)

- Certified Annuity Specialist (CAS)

- Certified Senior Advisor (CSA)

- Certified Retirement Financial Advisor (CRFA)

Benefits Copied

Skills management software can help financial organizations manage employee certifications and keep up with regulatory changes, ensuring they have the skills and knowledge to provide sound financial advice to clients.

Author Copied

Revisions Copied

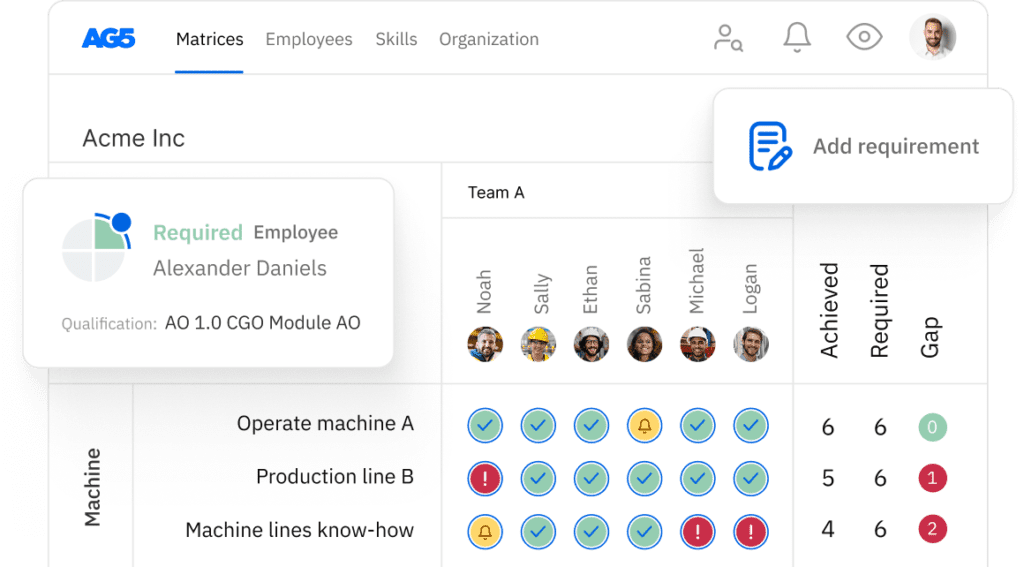

Tired of managing skills in Excel?

Say goodbye to Excel matrices. Start using AG5’s plug and play skill matrix software.

Recognized by G2 for Excellence in Skills Management