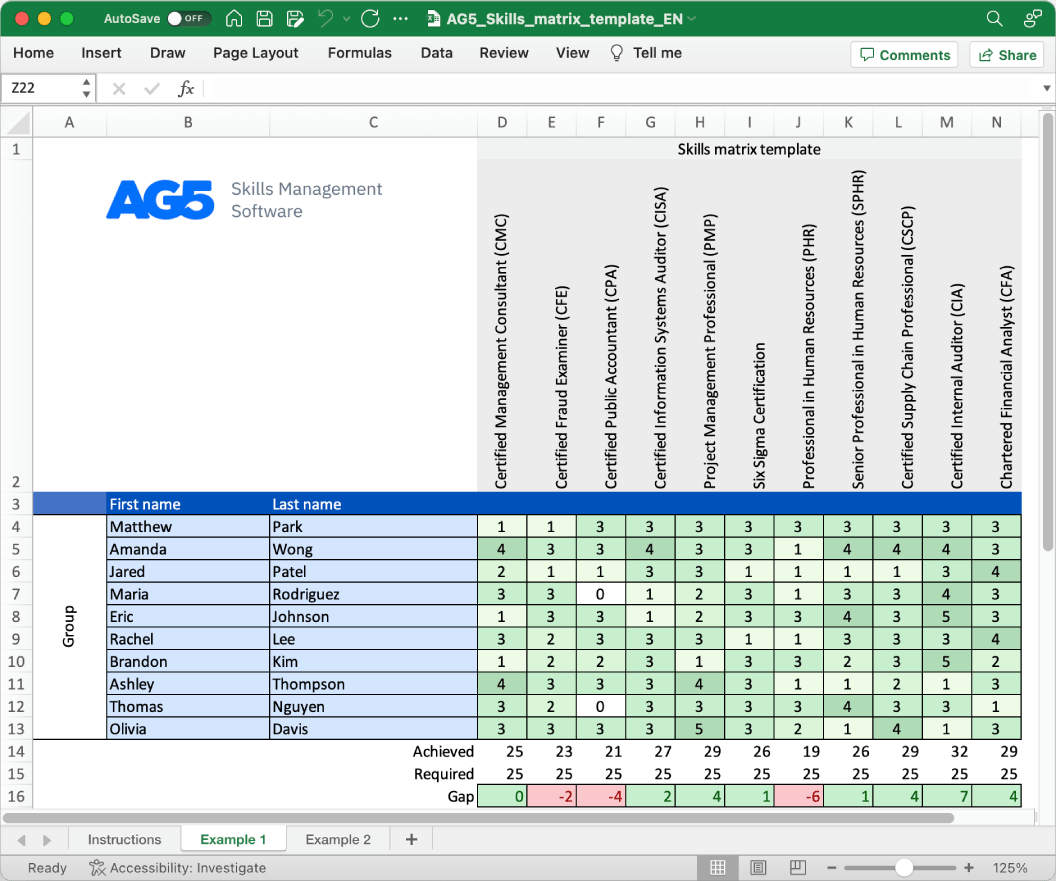

Insurance skills matrix template

A skills matrix template is a tool that can be used in insurance organizations to effectively manage and assess the skills and knowledge of individual employees or teams.

Download your free template here

Overview Copied

With our free insurance skills matrix template, you will receive a clear overview of the skills that are present in your organization, as well as those that are missing. Using this information, you can develop and implement a plan to ensure that your employees’ skills are up to date, comprehensive, compliant, and ready for the future.

- Chartered Property Casualty Underwriter (CPCU)

- Certified Insurance Counselor (CIC)

- Associate in Risk Management (ARM)

- Chartered Life Underwriter (CLU)

- Chartered Financial Consultant (ChFC)

- Certified Risk Manager (CRM)

- Accredited Advisor in Insurance (AAI)

- Certified Employee Benefits Specialist (CEBS)

- Certified Insurance Service Representative (CISR)

- Certified Professional Insurance Agent (CPIA)

- Certified Insurance Wholesaler (CIW)

- Certified Insurance Consultant (CIC)

- Associate in Insurance Accounting and Finance (AIAF)

- Associate in Fidelity and Surety Bonding (AFSB)

- Associate in Insurance Services (AIS)

- Associate in Claims (AIC)

- Associate in Marine Insurance Management (AMIM)

- Associate in Surplus Lines Insurance (ASLI)

- Associate in Reinsurance (ARe)

Benefits Copied

Skills management software can help insurance organizations track and manage employee certifications, ensuring they stay current on regulatory requirements and are able to provide the best coverage to their clients.

Author Copied

Revisions Copied

Use AG5 to identify skill gaps

Say goodbye to Excel matrices. Start using AG5’s plug and play skill matrix software.

ISO27001 certified Free trial available